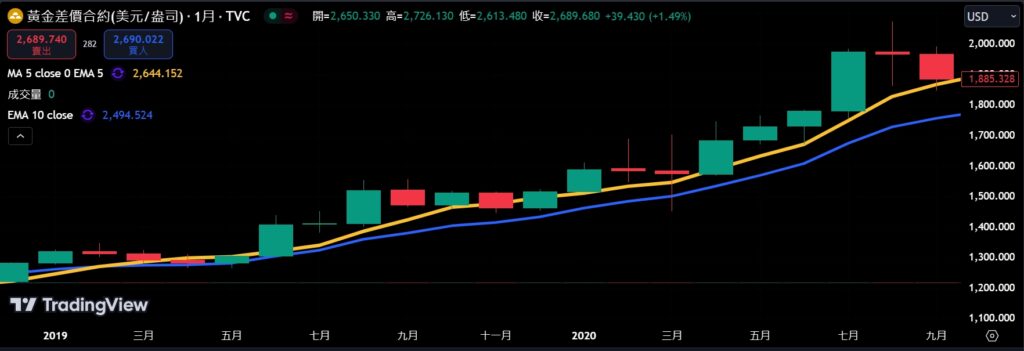

Gold’s Third Peak marked a historic moment in 2020 when the precious metal soared to an all-time high of $2,075 per ounce. This unprecedented rally was fueled by a perfect storm of factors, including the global COVID-19 pandemic, massive central bank stimulus measures, geopolitical tensions, and a weakening U.S. dollar. As a hedge against uncertainty, gold’s climb reflected its enduring role as a safe-haven asset during one of the most turbulent periods in modern history. In this post, we explore the key phases and events that led to this monumental surge, from its early rise in 2019 to its record-setting peak in August 2020.

Mid-2019: Central Banks Set the Stage for Gold’s Resurgence

In mid-2019, a pivotal shift in monetary policy by global central banks ignited gold’s ascent, creating a foundation for the historic rally that followed. The U.S. Federal Reserve cut interest rates in July 2019, its first rate reduction in over a decade, signaling a shift to looser monetary policy amid concerns about slowing global growth. The European Central Bank (ECB) and other central banks followed suit, further amplifying market uncertainty and weakening major currencies.

Geopolitical tensions added to the momentum. The U.S.-China trade war intensified in mid-2019, with new tariffs imposed on billions of dollars’ worth of goods, disrupting global supply chains and stoking fears of a global recession. In response, investors turned to gold as a hedge against volatility, pushing prices above $1,500 per ounce in August 2019, a level last seen in 2013.

Simultaneously, central banks, particularly in emerging markets like Russia and China, accelerated their gold purchases as part of efforts to reduce reliance on the U.S. dollar. The combination of monetary easing, trade tensions, and strategic gold acquisitions set the stage for the unprecedented surge in gold prices that would peak during the COVID-19 pandemic in 2020.

Late 2019 to Early 2020: Geopolitics and Pandemic Fears Drive Prices Higher

As 2019 came to a close, gold’s rally gained momentum, fueled by escalating geopolitical tensions and the first signs of a global health crisis. In January 2020, the U.S. carried out a drone strike that killed Iranian General Qasem Soleimani, sharply raising fears of conflict in the Middle East. Oil prices spiked, and gold surged above $1,600 per ounce, its highest level in nearly seven years, as markets braced for potential escalation.

Meanwhile, in December 2019, reports of a mysterious illness in Wuhan, China, began to emerge. By January, the outbreak was identified as a novel coronavirus (COVID-19), and its rapid spread triggered fears of a global pandemic. This added a new layer of uncertainty to the markets. Early supply chain disruptions in Asia and concerns about global economic fallout further bolstered gold’s appeal as a safe-haven asset.

Economic risks mounted as China imposed lockdowns in major cities, and by February, the virus was spreading globally. Central banks, including the Federal Reserve, signaled readiness to implement further monetary easing to counter the growing economic strain. Gold prices climbed steadily, reaching over $1,650 per ounce in March 2020.

This period marked the confluence of geopolitical shocks and the early stages of a global health crisis, both of which drove safe-haven demand for gold and set the stage for its historic 2020 peak.

March–April 2020: The Pandemic Sparks a Safe-Haven Rush

By March 2020, the COVID-19 pandemic had reached a critical tipping point, sending shockwaves through global markets. The World Health Organization (WHO) declared COVID-19 a global pandemic on March 11, 2020, leading to unprecedented economic shutdowns worldwide. Stock markets experienced historic declines, with the S&P 500 plummeting nearly 34% from its February high in just over a month. This market turmoil prompted a flight to safety, driving gold prices sharply higher.

As governments imposed strict lockdowns, supply chains were severely disrupted, and unemployment surged. In response, central banks and governments announced massive stimulus measures. The U.S. Federal Reserve slashed interest rates to near-zero on March 15, 2020, and launched unlimited quantitative easing programs to stabilize the economy. Similarly, governments worldwide announced multi-trillion-dollar fiscal stimulus packages, raising fears of inflation and currency devaluation.

Amid the panic, demand for gold as a safe-haven asset soared. Initially, in mid-March, a temporary liquidity crunch caused gold prices to dip as investors sold assets for cash. However, by April, gold had rebounded strongly, trading above $1,700 per ounce, as confidence in paper currencies weakened.

This period solidified gold’s role as a hedge against the combined effects of economic instability, inflation fears, and unprecedented monetary easing, setting the stage for its climb to record highs later in 2020.

June–August 2020: Gold’s Final Ascent to $2,075

As the global economy struggled to recover from the initial shock of the pandemic, gold entered a period of historic growth, reaching its all-time high of $2,075 per ounce in August 2020. Several key factors and events drove this final ascent.

1. Economic Uncertainty and Persistent COVID-19 Concerns

By mid-2020, the world was grappling with the prolonged economic effects of the pandemic. Resurgences of COVID-19 cases and uneven vaccine progress deepened fears of a long-term economic slowdown. Major economies, including the United States and European Union, faced mounting fiscal deficits as governments expanded stimulus measures to support their economies.

2. Weakened U.S. Dollar

The U.S. dollar, typically seen as a competing safe-haven asset, weakened significantly during this period. The U.S. Dollar Index (DXY) fell to its lowest levels in over two years by July 2020, driven by record-low interest rates, ballooning government debt, and expectations of prolonged monetary easing by the Federal Reserve. A weaker dollar made gold more attractive to international investors, further boosting demand.

3. Geopolitical Tensions

Geopolitical uncertainties added to the market’s nervousness. The U.S.-China tensions over trade, technology, and the COVID-19 origin story escalated during this period, contributing to a climate of uncertainty. Additionally, rising social unrest in the U.S. following the George Floyd protests added domestic instability to global concerns.

4. Central Bank Actions and Inflation Fears

Massive quantitative easing programs and stimulus measures by central banks around the world fueled concerns about potential long-term inflation and currency debasement. Investors turned to gold as a hedge against these risks, with ETFs (exchange-traded funds) tracking gold seeing record inflows. By August 2020, central banks’ expansive policies and global liquidity injections had pushed real yields on U.S. Treasury bonds deep into negative territory, making non-yielding assets like gold even more attractive.

5. The Record High: $2,075

Gold’s rally culminated on August 6, 2020, when it hit its all-time high of $2,075 per ounce. This milestone reflected the culmination of pandemic-driven uncertainty, inflation concerns, and a lack of confidence in fiat currencies. Although prices later corrected slightly, gold’s peak underscored its enduring role as a safe-haven asset during times of global crises.