Gold Reserves of the Central Bank of Turkey (2017-2024)

| Year | Gold Reserves (Tonnes) |

|---|---|

| 2017 | 404 |

| 2018 | 476 |

| 2019 | 438 |

| 2020 | 716 |

| 2021 | 720 |

| 2022 | 765 |

| 2023 | 800 |

| 2024 | 820 (estimated) |

2017: Responding to Inflation and Currency Volatility with Strategic Gold Buys

In 2017, the Central Bank of Turkey (CBRT) embarked on a significant shift in its reserve management strategy, focusing heavily on increasing its gold holdings. This move was largely driven by a confluence of economic challenges and geopolitical uncertainties.

Economic Instability and Rising Inflation

Turkey faced severe economic instability in 2017, characterized by rising inflation rates that reached around 11% by the end of the year. This was a significant jump compared to the previous years and one of the highest inflation rates among major emerging markets. The inflation surge was attributed to several factors, including increased consumer demand, higher import prices due to the depreciating lira, and rising energy costs.

Currency Volatility

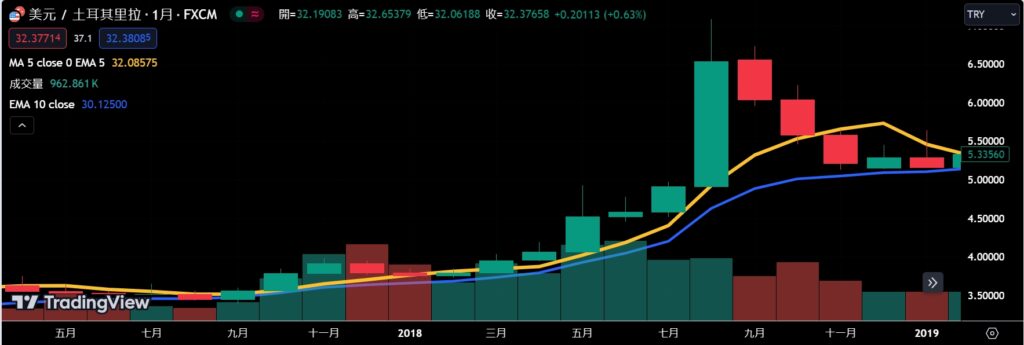

The Turkish lira experienced substantial volatility throughout 2017. The currency depreciated significantly against the US dollar, dropping from approximately 3.52 TRY/USD at the beginning of the year to around 3.77 TRY/USD by December. This depreciation was driven by a combination of domestic economic weaknesses and external factors, such as rising global interest rates and political uncertainties.

Geopolitical Tensions

2017 was marked by heightened geopolitical tensions for Turkey. Relations with key Western allies, including the United States and European Union, were strained due to several issues, including Turkey’s military actions in Syria and disputes over human rights and democracy. The political landscape within Turkey was also turbulent, following the aftermath of the failed coup attempt in 2016, leading to widespread purges and a state of emergency.

Strategic Response: Increasing Gold Reserves

In response to these challenges, the CBRT made a strategic decision to increase its gold reserves. By the end of 2017, Turkey’s gold reserves had risen to approximately 404 tonnes, up from 116 tonnes at the start of the year. This marked a significant increase and highlighted the CBRT’s commitment to safeguarding the country’s economic stability.

2018: Continuing the Trend Amidst Growing Economic Challenges

Escalating Inflation and Economic Strain

The Turkish economy continued to face significant inflationary pressures in 2018. The inflation rate, which had already been high in 2017, surged even further, reaching nearly 20% by the end of the year. Several factors contributed to this:

- Persistent Currency Depreciation: The Turkish lira depreciated dramatically throughout 2018, losing approximately 30% of its value against the US dollar. This sharp decline further increased the cost of imports, fueling inflation.

- Higher Import Costs: The weakened lira made imported goods more expensive, leading to higher prices for a wide range of products, from raw materials to consumer goods.

- Rising Energy Prices: Global oil prices increased, which compounded the inflationary pressures in Turkey, a net importer of energy. The higher cost of energy imports directly impacted overall price levels in the economy.

Currency Crisis

The Turkish lira crisis was a defining event of 2018. Several factors triggered and exacerbated this crisis:

- Diplomatic Spat with the US: Tensions between Turkey and the United States escalated dramatically, particularly over the detention of American pastor Andrew Brunson. The US imposed sanctions and tariffs on Turkish steel and aluminum, which further eroded confidence in the Turkish economy.

- Economic Policies: Concerns about the Turkish government’s economic policies, including pressure on the central bank to keep interest rates low despite rising inflation, undermined investor confidence. President Recep Tayyip Erdoğan’s unorthodox views on interest rates and monetary policy further spooked markets.

- Capital Outflows: The combination of geopolitical tensions, economic mismanagement, and rising US interest rates led to significant capital outflows from Turkey. Investors moved their money to safer, more stable environments, leading to a sharp decline in the lira’s value.

Geopolitical Tensions

The geopolitical landscape remained turbulent:

- Continued Strains with Western Allies: The strained relationship with the US over the Brunson case and other issues continued to create uncertainty. Turkey’s rapprochement with Russia and its military operations in Syria also complicated its relationships with NATO allies.

- Regional Conflicts: Turkey’s involvement in regional conflicts, particularly in Syria, continued to create geopolitical risks. These tensions had economic implications, including the potential for sanctions and reduced foreign investment.

2019: Adjusting Strategies as Global and Domestic Pressures Mount

Persistent Economic Challenges

Turkey’s economy continued to grapple with high inflation and currency volatility in 2019:

- Inflation Pressure: Inflation remained a significant challenge, with the rate hovering around 11-12% for much of the year. Although slightly lower than the peak in 2018, inflation rates were still high, affecting consumer prices and economic stability.

- Currency Fluctuations: The Turkish lira remained volatile, trading at around 5.95 TRY/USD by the end of the year. This volatility was driven by both domestic economic policies and global market conditions, including fluctuating oil prices and trade tensions.

Geopolitical Tensions and Global Pressures

Turkey’s geopolitical landscape continued to impact its economic stability:

- US-Turkey Relations: Relations with the United States remained strained, particularly over Turkey’s purchase of the Russian S-400 missile defense system. This decision led to threats of sanctions from the US and Turkey’s removal from the F-35 fighter jet program, adding to economic uncertainty.

- Military Operations: Turkey launched Operation Peace Spring in northern Syria in October 2019, targeting Kurdish forces. This military action heightened geopolitical risks and drew international criticism, leading to further economic and diplomatic pressures.

Domestic Political and Economic Policies

Domestically, Turkey’s political and economic policies played a crucial role in shaping the CBRT’s strategies:

- Monetary Policy Challenges: President Recep Tayyip Erdoğan’s unorthodox views on interest rates continued to influence the CBRT’s policies. Despite high inflation, there was significant political pressure to keep interest rates low to stimulate economic growth.

- Leadership Changes: In July 2019, Murat Uysal was appointed as the new governor of the CBRT, replacing Murat Çetinkaya. This leadership change was partly due to disagreements over monetary policy, particularly interest rate hikes aimed at controlling inflation.

Adjusting Gold Reserve Strategies

Amid these challenges, the CBRT made strategic adjustments to its gold reserve policies:

Gold Holdings Fluctuate: By the end of 2019, Turkey’s gold reserves were approximately 438 tonnes, a slight decrease from 476 tonnes in 2018. This fluctuation reflected the complex balance of using gold reserves to stabilize the economy while continuing to accumulate gold as a hedge against ongoing uncertainties.

2020: A Record-Breaking Year of Gold Purchases During Global Pandemic

In 2020, the Central Bank of Turkey (CBRT) significantly increased its gold reserves, making it the largest buyer of gold among central banks globally. This strategic move came amidst the unprecedented economic and financial challenges posed by the COVID-19 pandemic. Here’s a detailed account of the major events and factors driving Turkey’s record-breaking gold purchases in 2020.

Global Pandemic and Economic Turmoil

The COVID-19 pandemic triggered a global economic crisis, affecting countries worldwide, including Turkey:

- Economic Contraction: The Turkish economy, like many others, faced a sharp contraction due to lockdowns, reduced consumer spending, and disruptions in trade and supply chains. The IMF estimated that Turkey’s GDP contracted by around 5% in the first half of 2020.

- Inflation and Currency Depreciation: Inflation remained high, and the Turkish lira continued to depreciate significantly, falling to record lows. By the end of 2020, the lira had lost nearly 20% of its value against the US dollar, exacerbating economic instability.

Record-Breaking Gold Purchases

Against this backdrop, the CBRT embarked on a record-breaking spree of gold purchases:

- Significant Increase in Gold Reserves: Turkey’s gold reserves increased by approximately 278 tonnes in 2020, reaching about 716 tonnes by the end of the year. This marked the highest annual increase in Turkey’s history and positioned the CBRT as the largest gold buyer globally for the year.

- Strategic Diversification: The CBRT’s substantial gold purchases were part of a broader strategy to diversify foreign exchange reserves and reduce reliance on the US dollar. Gold provided a hedge against the depreciation of the lira and inflation, offering a stable store of value during turbulent times.

Geopolitical and Domestic Factors

Several geopolitical and domestic factors also influenced Turkey’s gold buying strategy:

- US Sanctions and Geopolitical Risks: Ongoing tensions with the United States, including the threat of sanctions over Turkey’s purchase of the Russian S-400 missile defense system, added to the economic uncertainty. Gold served as a protective measure against potential economic sanctions and geopolitical risks.

- Domestic Political Landscape: The domestic political environment remained volatile, with President Recep Tayyip Erdoğan’s administration facing criticism over its handling of the economy. The CBRT’s gold purchases were aimed at bolstering economic confidence and demonstrating a commitment to financial stability.

Policy Responses and Economic Measures

The CBRT implemented several policy measures in response to the economic crisis:

- Monetary Easing: To support the economy, the CBRT lowered interest rates several times in the early part of the year, despite high inflation. This move aimed to stimulate economic activity but also contributed to further currency depreciation.

- Foreign Exchange Interventions: The central bank intervened in foreign exchange markets to stabilize the lira, utilizing its reserves, including gold, to manage currency volatility.

2021: Stabilizing and Consolidating Gold Reserves for Future Security

Economic Recovery Amid Continued Challenges

The global economy, including Turkey’s, began to recover from the depths of the COVID-19 pandemic, but challenges remained:

- Economic Growth: Turkey’s economy showed signs of recovery, with GDP growth rebounding to around 11% in 2021, driven by increased domestic demand and strong exports. However, the underlying economic fundamentals were still fragile.

- Inflation and Currency Pressures: Inflation continued to be a significant concern, with rates fluctuating around 15-20% throughout the year. The Turkish lira remained volatile, trading at around 13.5 TRY/USD by the end of the year, despite efforts to stabilize it.

Strategic Gold Reserve Management

Building on the substantial gold acquisitions of 2020, the CBRT aimed to stabilize and consolidate its gold reserves:

- Maintaining High Gold Reserves: By the end of 2021, Turkey’s gold reserves stood at approximately 720 tonnes. The focus shifted from aggressive accumulation to maintaining a stable and substantial reserve base to ensure economic security.

- Hedge Against Inflation: Given the persistent inflationary pressures, gold continued to serve as a critical hedge. The CBRT’s strategy aimed to protect the value of its reserves and maintain confidence in the Turkish economy.

Geopolitical and Domestic Developments

Turkey’s geopolitical and domestic landscape remained complex, influencing its economic strategies:

- US-Turkey Relations: Relations with the United States were still strained, primarily over Turkey’s purchase of the Russian S-400 missile defense system and other geopolitical issues. However, there were efforts to manage these tensions and avoid further economic sanctions.

- Regional Conflicts: Turkey’s involvement in regional conflicts, particularly in Syria, continued to create geopolitical risks. Additionally, tensions in the Eastern Mediterranean over territorial waters and natural gas exploration contributed to the complex geopolitical environment.

Policy Responses and Economic Measures

The CBRT and the Turkish government implemented several measures to address ongoing economic challenges:

- Monetary Policy Adjustments: The CBRT faced the delicate task of balancing interest rate policies to control inflation while supporting economic growth. In 2021, there were instances of rate hikes aimed at curbing inflation, despite political pressures to keep rates low.

- Foreign Exchange Interventions: The central bank continued to intervene in foreign exchange markets to support the lira. These interventions included using foreign exchange and gold reserves to stabilize the currency and manage market expectations.

2022: Increasing Gold Holdings to Combat Persistent Inflation

Persistent Inflation and Economic Challenges

Inflation remained a critical issue for Turkey in 2022:

- High Inflation Rates: Inflation rates continued to soar, reaching levels around 70% by the middle of the year. This was driven by several factors, including the ongoing depreciation of the Turkish lira, high energy prices, and global supply chain disruptions.

- Currency Depreciation: The Turkish lira experienced further depreciation, exacerbating inflationary pressures. By the end of 2022, the lira had lost a significant portion of its value against major currencies, contributing to the rising cost of imports and overall price levels.

Geopolitical Tensions and Regional Conflicts

Geopolitical dynamics played a significant role in shaping Turkey’s economic landscape:

- Eastern Mediterranean Tensions: Ongoing disputes over natural gas exploration rights in the Eastern Mediterranean continued to strain Turkey’s relations with neighboring countries and the European Union.

- Regional Conflicts: Turkey’s involvement in regional conflicts, particularly in Syria, and its complex relationship with NATO allies, added to geopolitical uncertainties. These tensions had economic repercussions, including the potential for sanctions and reduced foreign investment.

Strategic Gold Reserve Management

In response to these challenges, the CBRT intensified its focus on increasing gold reserves:

Significant Increase in Gold Reserves: By the end of 2022, Turkey’s gold reserves had increased to approximately 765 tonnes, up from 720 tonnes at the end of 2021. This significant accumulation underscored the CBRT’s commitment to using gold as a hedge against inflation and economic instability.

Domestic Economic Policies

Domestic economic policies also influenced the CBRT’s strategies:

- Interest Rate Policies: Despite high inflation, the CBRT faced political pressure to maintain low interest rates to support economic growth. This unconventional approach to monetary policy contributed to continued currency depreciation.

- Economic Stimulus Measures: The Turkish government implemented various stimulus measures to support the economy, including financial aid packages and incentives for key sectors. These measures aimed to mitigate the impact of inflation and promote economic stability.

2023: Sustained Gold Accumulation Amidst Ongoing Geopolitical Tensions

Geopolitical Tensions

Geopolitical dynamics remained a significant concern for Turkey in 2023:

- Eastern Mediterranean Disputes: The ongoing disputes over natural gas exploration rights in the Eastern Mediterranean continued to strain relations with Greece, Cyprus, and the European Union. These tensions led to occasional escalations, impacting regional stability and economic confidence.

- Syria and Regional Conflicts: Turkey’s military operations in Syria persisted, aimed at securing its borders and addressing security concerns related to Kurdish forces. These operations continued to create friction with the United States and NATO allies, adding to geopolitical uncertainties.

- Relations with Western Allies: Strained relations with Western allies, particularly the United States, over issues such as defense policies and human rights concerns, remained a significant source of tension. The potential for economic sanctions and diplomatic conflicts influenced Turkey’s economic strategies.

Economic Challenges

The economic environment in Turkey was marked by ongoing challenges:

- Inflation and Currency Volatility: Inflation continued to be a critical issue, with rates fluctuating around 50-60%. The Turkish lira remained volatile, experiencing significant fluctuations against major currencies. By the end of 2023, the lira’s value had stabilized somewhat but remained under pressure.

- Monetary Policy Pressures: The CBRT faced significant pressure to balance interest rate policies. Political influences pushed for lower rates to stimulate growth, while economic conditions necessitated measures to control inflation and stabilize the currency.

Sustained Gold Accumulation

Amidst these challenges, the CBRT maintained its strategy of sustained gold accumulation:

- Increase in Gold Reserves: By the end of 2023, Turkey’s gold reserves had increased to approximately 800 tonnes, up from 765 tonnes at the end of 2022. This continued accumulation underscored the CBRT’s commitment to using gold as a hedge against economic instability and geopolitical risks.

Key Economic Policies

The CBRT and the Turkish government implemented several key policies in 2023:

Interest Rate Adjustments: The CBRT made strategic interest rate adjustments to manage inflation and support economic growth. Despite political pressures for lower rates, the CBRT balanced these demands with the need to control inflation.

Foreign Exchange Interventions: The CBRT continued to intervene in foreign exchange markets to stabilize the lira. These interventions included using gold reserves to support the currency and manage market expectations.

2024: Projected Growth as Turkey Continues to Bolster Its Gold Reserves

Economic and Inflationary Challenges

The Turkish economy continues to face significant challenges:

- Persistent Inflation: Inflation remains a critical issue, with rates projected to fluctuate around 45-55%. High consumer prices and cost pressures continue to affect the economic landscape.

- Currency Management: The Turkish lira, while somewhat stabilized compared to previous years, still faces volatility. The CBRT’s ongoing efforts to manage the currency’s value include strategic use of foreign exchange and gold reserves.

Geopolitical Tensions

Geopolitical factors continue to shape Turkey’s economic strategies:

- Eastern Mediterranean Disputes: The situation in the Eastern Mediterranean remains tense, with ongoing disputes over natural gas exploration rights. Diplomatic efforts are ongoing, but the potential for conflict impacts economic stability.

- Regional Conflicts and Alliances: Turkey’s involvement in regional conflicts, particularly in Syria and broader Middle Eastern dynamics, continues to influence its geopolitical standing. Balancing relationships with NATO allies, Russia, and regional partners remains complex.

- EU and US Relations: Turkey’s relations with the European Union and the United States remain strained but are showing signs of cautious improvement. Efforts to ease tensions and negotiate economic and security agreements are underway.

Strategic Gold Reserve Management

The CBRT’s strategy to bolster its gold reserves continues to be a cornerstone of its economic policy:

- Projected Increase in Gold Reserves: By the end of 2024, Turkey’s gold reserves are projected to reach approximately 820 tonnes, up from 800 tonnes at the end of 2023. This continued accumulation reflects the CBRT’s commitment to using gold as a hedge against economic volatility and geopolitical risks.

Key Economic Policies

Several key economic policies and measures are anticipated in 2024:

- Interest Rate Policies: The CBRT is expected to continue adjusting interest rates to balance the need for economic growth with the necessity of controlling inflation. This delicate balance remains crucial for economic stability.

- Fiscal and Monetary Interventions: The Turkish government, in coordination with the CBRT, is likely to implement various fiscal and monetary measures to support economic stability. This includes potential stimulus packages and targeted support for key sectors.