Catalyzing the 1980 Gold Price Explosion, the dismantling of the Bretton Woods system in 1971 set off a chain reaction of economic and geopolitical events that culminated in gold reaching historic highs. This period, marked by unprecedented volatility and uncertainty, saw the precious metal soar as investors sought refuge from rampant inflation, oil crises, and geopolitical tensions. From the end of fixed exchange rates to the shocks of the Iranian Revolution and the second oil crisis, the 1970s were a decade of dramatic shifts that ultimately drove gold prices to their peak in 1980. Understanding these events is crucial to comprehending the dynamics that propelled gold to the forefront of global financial markets.

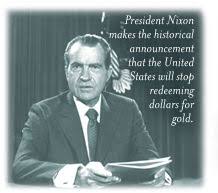

August 1971: Nixon Ends Gold Convertibility – The Beginning of the End for Bretton Woods

In the decades following World War II, the Bretton Woods system established a framework for international monetary policy, with the US dollar pegged to gold at $35 per ounce, and other currencies pegged to the US dollar. This system aimed to provide stability and facilitate post-war economic recovery. However, by the late 1960s, the sustainability of Bretton Woods faced mounting pressures due to various economic challenges.

Economic Strains Leading to the Collapse:

- US Trade Deficits: The United States began experiencing significant trade deficits, weakening the dollar’s value.

- Excessive Dollar Printing: To finance the Vietnam War and expansive domestic programs, the US printed more dollars, causing concerns about inflation and undermining confidence in the dollar’s gold convertibility.

- Gold Reserves Drain: As confidence in the dollar eroded, other countries started demanding gold in exchange for their dollar holdings, leading to a rapid depletion of US gold reserves.

The Nixon Shock: On August 15, 1971, President Richard Nixon announced a series of economic measures that would become known as the “Nixon Shock.” The most consequential was the suspension of the dollar’s convertibility into gold. This move effectively ended the Bretton Woods system, as it meant the US dollar was no longer backed by a tangible asset, and currencies began to float freely against each other.

Immediate Consequences:

- Currency Volatility: The end of fixed exchange rates led to increased volatility in currency markets.

- Inflation: The decoupling of the dollar from gold contributed to inflationary pressures, as there were fewer constraints on monetary policy.

- Shift to Floating Rates: By 1973, major currencies were floating, reflecting market conditions rather than being pegged to the dollar or gold.

system in 1971 set off a chain of economic and geopolitical events that significantly impacted global markets and investor behavior. The move away from fixed exchange rates, coupled with inflationary pressures and geopolitical crises, created an environment in which gold thrived as a safe haven, culminating in the dramatic price surge of 1980.

1973: Oil Crisis and Stagflation – Fueling Economic Uncertainty

The early 1970s were marked by a series of profound economic shifts, set in motion by the collapse of the Bretton Woods system in 1971. One of the most significant events during this period was the 1973 oil crisis, which, combined with stagflation, profoundly influenced global economies and set the stage for the dramatic rise in gold prices leading up to 1980.

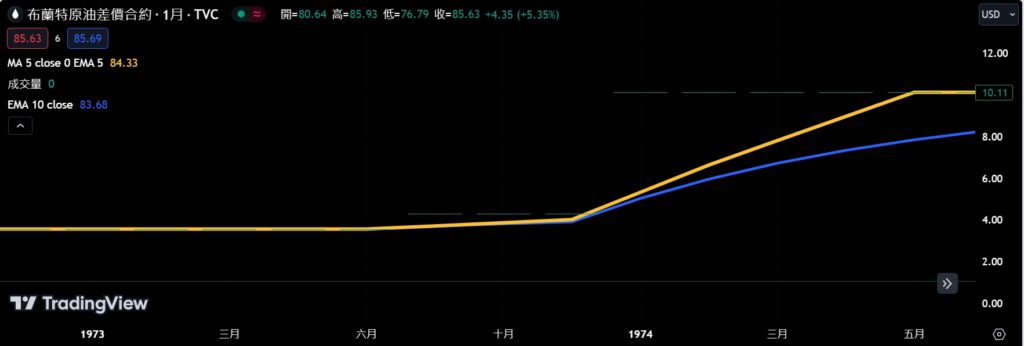

The 1973 Oil Crisis:

- Background:

- The Organization of Arab Petroleum Exporting Countries (OAPEC), in response to the United States’ support for Israel during the Yom Kippur War, declared an oil embargo in October 1973.

- The embargo targeted nations perceived as supporting Israel, including the United States, the Netherlands, and others.

- Impact:

- Oil Prices Quadruple: The price of oil skyrocketed from around $3 per barrel to nearly $12 per barrel within months.

- Economic Shock: The sudden increase in energy prices sent shockwaves through the global economy, leading to severe disruptions in production and transport costs.

Stagflation:

- Definition: Stagflation is an economic condition characterized by stagnant economic growth, high unemployment, and high inflation—a rare and troubling combination.

- Causes:

- Oil Price Shock: The increased cost of energy significantly contributed to rising inflation while simultaneously slowing economic growth.

- Monetary Policy: Attempts to counter inflation through loose monetary policy initially led to higher inflation without spurring economic growth.

- Effects:

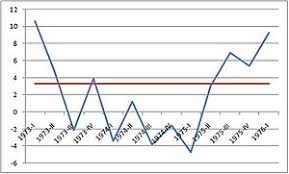

- High Inflation: Inflation rates soared, with annual inflation in the United States reaching over 11% in 1974.

- Economic Slowdown: Economic growth stagnated, and unemployment rates rose, creating a challenging economic environment.

Economic and Market Reactions:

- Flight to Safe Havens: As inflation eroded the value of currencies and economic uncertainty increased, investors sought refuge in assets perceived as safe havens.

- Gold as a Hedge: Gold, traditionally seen as a hedge against inflation and economic instability, became increasingly attractive. The demand for gold surged as investors looked to protect their wealth from the devaluing effects of inflation.

Key Developments:

- Gold Price Increase: Following the oil crisis and the onset of stagflation, gold prices began to climb steadily. From around $64 per ounce in 1972, gold reached approximately $195 per ounce by the end of 1974.

- Government Policies: Governments around the world grappled with policy responses to manage the economic fallout. However, the dual challenge of high inflation and unemployment made effective policy formulation difficult.

Global Implications:

- Economic Realignment: The oil crisis and resulting stagflation caused significant economic realignment, with energy-importing nations experiencing severe economic pressures.

- Shift in Power: Oil-producing countries gained substantial economic power and influence, reshaping global economic and geopolitical dynamics.

1974: The Recession Takes Hold – Investors Seek Safe Havens

Following the collapse of the Bretton Woods system in 1971 and the subsequent oil crisis of 1973, the global economy entered a period of severe instability. By 1974, the world was grappling with a deep recession, exacerbating economic uncertainties and driving investors towards safe havens like gold.

The 1974 Recession:

- Economic Context:

- The recession of 1974 was one of the most severe economic downturns since the Great Depression.

- It was characterized by a combination of high inflation, high unemployment, and stagnant economic growth—collectively known as stagflation.

- Triggers:

- Oil Crisis Aftermath: The 1973 oil crisis led to a dramatic increase in energy prices, which rippled through the global economy, raising production and transportation costs.

- Monetary Policy Responses: Efforts to combat inflation through restrictive monetary policies resulted in higher interest rates, further stifling economic growth.

Key Economic Events of 1974:

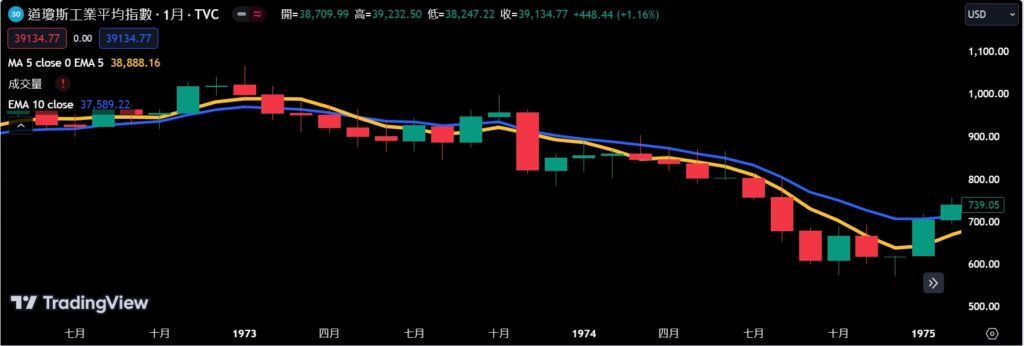

- Stock Market Decline:

- The global stock markets experienced significant declines. The US stock market, for instance, saw the Dow Jones Industrial Average (DJIA) drop by over 45% from its 1973 peak to its 1974 trough.

- This decline reflected the loss of investor confidence amid rising economic uncertainties.

- Inflation and Unemployment:

- Inflation remained persistently high, with the US Consumer Price Index (CPI) reaching annual rates of over 11%.

- Unemployment rates also climbed, with the US unemployment rate exceeding 7% by the end of 1974.

Investor Behavior:

- Flight to Safety:

- Faced with volatile stock markets and declining economic prospects, investors increasingly sought safe-haven assets.

- Gold, traditionally viewed as a store of value and a hedge against inflation, became an attractive option.

- Gold Price Surge:

- The price of gold saw significant increases during this period. From around $65 per ounce in 1973, gold prices rose to approximately $185 per ounce by the end of 1974.

- The demand for gold was driven by its perceived stability and ability to preserve wealth in times of economic distress.

Global Implications:

- Economic Policies:

- Governments and central banks worldwide grappled with policy responses to the recession. The complexity of stagflation—where typical tools to combat inflation (like raising interest rates) could worsen unemployment—made effective policy challenging.

- Efforts to stabilize economies often involved a mix of fiscal austerity and monetary tightening, further complicating the recovery process.

- Geopolitical Shifts:

- The economic difficulties of 1974 also had geopolitical implications. For instance, oil-producing nations, bolstered by their newfound economic power, exerted greater influence on the global stage.

- The economic strain in the West led to shifts in political priorities and policies, focusing more on energy independence and economic reforms.

Long-term Effects:

- Legacy of Inflation:

- The high inflation of the 1970s left a lasting impact on economic policy and investor behavior. The fear of inflation became a significant factor in investment decisions and monetary policy considerations for years to come.

- Gold’s Role in Portfolios:

- The experience of the 1970s reinforced the role of gold as a critical component of investment portfolios, especially during times of economic uncertainty. The belief in gold’s value preservation capabilities persisted and grew stronger.

1976: Formal End of Bretton Woods – The Jamaica Accords and Floating Currencies

The Jamaica Accords:

- Overview:

- The Jamaica Accords were a series of agreements reached during an International Monetary Fund (IMF) meeting in Kingston, Jamaica, in January 1976.

- These accords formalized the end of the Bretton Woods system and established a new framework for international monetary relations.

- Key Provisions:

- Floating Exchange Rates: Currencies were allowed to float freely against one another, reflecting supply and demand in the foreign exchange markets.

- Gold’s Official Role: Gold was officially demonetized, ending its role as the basis for international monetary transactions. The fixed price of gold was abandoned, allowing market forces to determine its value.

- IMF Reforms: The IMF’s role was redefined, focusing on surveillance of exchange rate policies and providing financial support to member countries experiencing balance of payments problems.

Gold Price Trends:

- In the immediate aftermath of the Jamaica Accords, gold prices experienced significant increases. From around $140 per ounce in early 1976, gold rose to approximately $180 per ounce by the end of the year.

- This upward trend continued as economic conditions remained volatile and inflationary pressures persisted.

Ongoing Inflation:

- Throughout the mid-1970s, many economies grappled with high inflation rates. In the United States, inflation averaged around 7-8% annually during this period.

- The oil crises of 1973 and 1979 further exacerbated inflationary pressures, contributing to a general sense of economic instability.

Conclusion: The formal end of the Bretton Woods system through the Jamaica Accords in 1976 was a watershed moment in global economic history. The shift to floating exchange rates and the demonetization of gold reshaped international monetary relations, introducing new dynamics of volatility and uncertainty.

1978: Iranian Revolution – Rising Geopolitical Tensions

The late 1970s were marked by significant geopolitical upheavals, none more impactful on the global stage than the Iranian Revolution of 1978-1979.

Background of the Iranian Revolution:

- Historical Context:

- Iran, under the leadership of Shah Mohammad Reza Pahlavi, was a key ally of the United States in the Middle East.

- The Shah’s regime was known for its pro-Western stance and aggressive modernization policies, which were accompanied by widespread discontent and political repression.

- Causes of the Revolution:

- Economic Discontent: Despite modernization, economic inequalities and inflation led to widespread dissatisfaction among the Iranian population.

- Political Repression: The Shah’s authoritarian rule, including suppression of political opposition and civil liberties, fueled unrest.

- Religious Opposition: Ayatollah Ruhollah Khomeini emerged as a central figure leading the opposition, criticizing the Shah’s regime for its secular policies and ties to the West.

Key Events of the Iranian Revolution:

- Mass Protests:

- In late 1978, massive protests erupted across Iran, drawing millions of people. These protests were met with violent crackdowns by the Shah’s security forces.

- Strikes and demonstrations crippled the economy, increasing the pressure on the regime.

- Regime Collapse:

- By January 1979, the Shah fled Iran amid escalating violence and political instability.

- In February 1979, Ayatollah Khomeini returned from exile and established an Islamic Republic, fundamentally altering Iran’s political landscape.

Impact on Global Markets:

- Oil Supply Disruptions:

- Iran was one of the world’s largest oil producers, and the revolution significantly disrupted its oil exports.

- The resulting decrease in oil supply contributed to a sharp rise in global oil prices, exacerbating inflationary pressures worldwide.

- Geopolitical Instability:

- The revolution marked a dramatic shift in Middle Eastern geopolitics, leading to increased tensions between Iran and the West, particularly the United States.

- The instability in Iran also heightened fears of further unrest in the region, which could threaten other oil supplies.

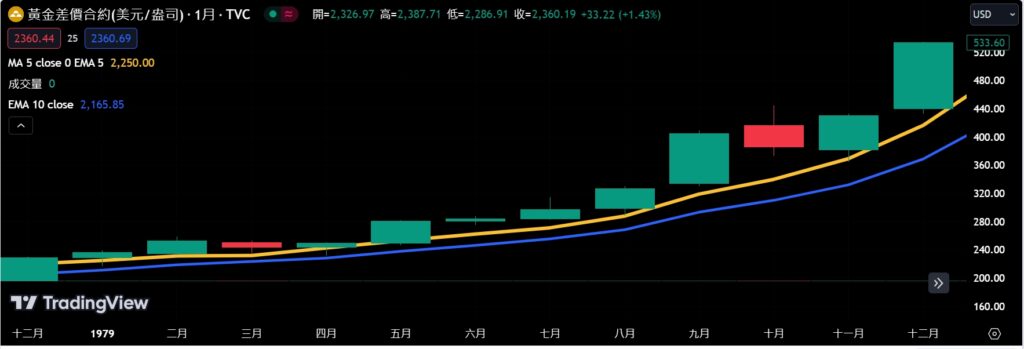

Gold Price Increase:

- Gold prices responded sharply to the rising geopolitical tensions. From around $200 per ounce in early 1978, gold prices rose steadily, reaching approximately $400 per ounce by the end of 1979.

Broader Economic Context:

- Stagflation Continues:

- The economic conditions of the late 1970s were characterized by stagflation—persistent high inflation coupled with stagnant economic growth and rising unemployment.

- The oil price shocks from the Iranian Revolution further exacerbated these conditions, leading to higher inflation rates and deeper economic malaise.

- Policy Responses:

- Governments and central banks faced challenges in addressing the dual issues of inflation and economic stagnation. Tightening monetary policies to control inflation often led to higher interest rates, which further slowed economic growth.

- The complexity of these economic conditions made effective policy-making difficult, contributing to ongoing economic instability.

Long-term Effects:

Geopolitical Shifts:

- The Iranian Revolution had lasting impacts on Middle Eastern politics and global relations, shaping the geopolitical landscape for years to come.

- The rise of an Islamic Republic in Iran introduced new dynamics in regional and international politics, affecting global energy markets and strategic alliances.

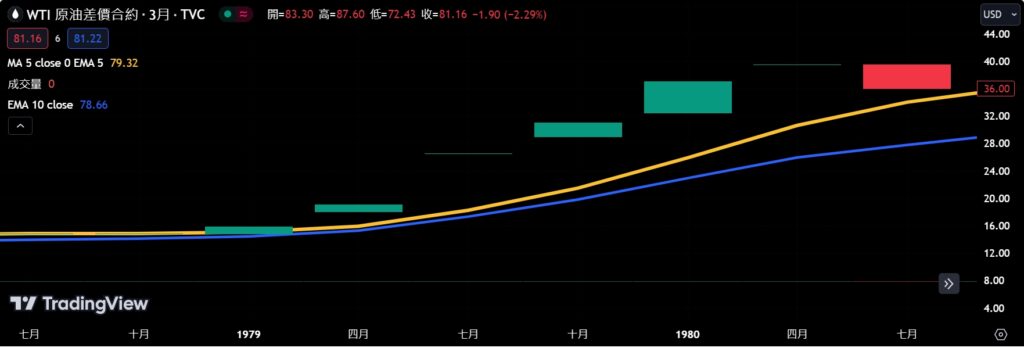

1979: Second Oil Crisis – Skyrocketing Inflation Rates

Background of the Second Oil Crisis:

- Origins:

- The second oil crisis began in 1979, following the Iranian Revolution in 1978-1979, which disrupted Iran’s oil production and exports.

- The instability in Iran led to a decrease in global oil supply, causing panic and speculative buying in the oil markets.

- Impact on Oil Prices:

- Oil prices more than doubled in 1979, increasing from around $15 per barrel at the beginning of the year to over $39 per barrel by the end of 1979.

- The dramatic rise in oil prices exacerbated inflationary pressures worldwide, significantly impacting both developed and developing economies.

Economic Context:

- Inflation:

- The second oil crisis came on top of already high inflation rates, a legacy of the 1973 oil crisis and the end of the Bretton Woods system.

- In the United States, inflation surged, with the Consumer Price Index (CPI) reaching an annual rate of 13.3% in 1979, the highest since World War II.

- Stagflation:

- The term “stagflation” was used to describe the economic condition of the time, where high inflation coexisted with stagnant economic growth and high unemployment.

- This challenging economic environment made traditional monetary and fiscal policy tools less effective, as efforts to curb inflation often led to higher unemployment and slower growth.

Gold Price Surge:

- Gold prices reacted sharply to the economic conditions, rising from approximately $226 per ounce at the beginning of 1979 to around $512 per ounce by the end of the year.

Global Economic and Geopolitical Implications:

- Economic Policies:

- Governments and central banks worldwide struggled to respond to the dual challenges of inflation and economic stagnation.

- In the United States, the Federal Reserve, under Chairman Paul Volcker, adopted aggressive monetary tightening policies, raising interest rates to unprecedented levels in an effort to combat inflation.

- Geopolitical Tensions:

- The second oil crisis highlighted the vulnerability of global economies to geopolitical events, particularly those affecting oil supplies.

- The crisis underscored the importance of energy security and prompted many countries to seek ways to reduce their dependence on oil imports, including investing in alternative energy sources and improving energy efficiency.

Long-term Effects:

Monetary Policy Changes:

- The aggressive monetary policies adopted in response to the second oil crisis had long-term implications for economic management. High interest rates eventually succeeded in reducing inflation but also led to a severe recession in the early 1980s.

- These experiences influenced future central bank policies, emphasizing the need for maintaining price stability.

1980: Gold Hits Historic Highs – Peak of the Precious Metal’s Bull Run

The year 1980 marked the climax of an extraordinary bull run in gold prices, driven by a decade of economic and geopolitical turmoil following the collapse of the Bretton Woods system in 1971. This peak, characterized by gold reaching unprecedented heights, was the result of compounded factors such as inflation, geopolitical instability, and shifts in investor behavior.

The Context Leading to 1980:

- Collapse of Bretton Woods:

- In 1971, President Richard Nixon announced the end of the dollar’s convertibility to gold, dismantling the Bretton Woods system and leading to floating exchange rates.

- This move created significant currency volatility and contributed to inflationary pressures.

- 1973 Oil Crisis:

- The Yom Kippur War and the subsequent OPEC oil embargo caused a fourfold increase in oil prices, leading to high inflation and economic stagnation in the mid-1970s.

- 1978 Iranian Revolution:

- The revolution disrupted oil supplies from one of the world’s largest producers, further exacerbating global economic instability and contributing to rising oil prices.

- 1979 Second Oil Crisis:

- The Iranian Revolution and subsequent geopolitical tensions led to another spike in oil prices, driving inflation even higher and creating an environment of economic uncertainty.

Key Events in 1980:

- Gold Price Surge:

- As 1980 began, gold prices skyrocketed, peaking at an all-time high of around $850 per ounce in January (equivalent to approximately $2,700 per ounce in 2020 dollars when adjusted for inflation).

- This dramatic rise was driven by a flight to safety, as investors sought to protect their wealth from the rampant inflation and economic instability of the time.

- Inflation and Economic Policies:

- Inflation in the United States reached an annual rate of 13.5% in 1980, the highest in post-World War II history.

- The Federal Reserve, under Chairman Paul Volcker, responded with aggressive monetary tightening, raising the federal funds rate to nearly 20% to combat inflation.

- Geopolitical Instability:

- The Soviet invasion of Afghanistan in December 1979 added to global geopolitical tensions, heightening fears of broader conflicts and contributing to market instability.

- This event, alongside ongoing tensions in the Middle East, underscored the precarious geopolitical environment, reinforcing gold’s appeal as a safe-haven asset.

Long-term Effects:

Economic Adjustments:

- The aggressive interest rate hikes by the Federal Reserve eventually succeeded in bringing down inflation, but they also triggered a severe recession in the early 1980s.

- The economic policies and adjustments during this period laid the groundwork for the eventual stabilization and growth of the global economy in the subsequent decade.

About gold market,you want to know…

- Russia’s Gold Reserves Since 2009 Surge by 360% : Inside the Central Bank’s Strategic Move

- China Buys Over 1,200 Tons of Gold Since 2009: A Decade-Long Strategic Rush

- India’s Golden Surge: RBI Increases Gold Reserves by almost 500 Tonnes Since 2009 Amid Global Economic Shifts

- Central Bank of Turkey Increased Gold Reserves by Over 100% from 2017 to 2024