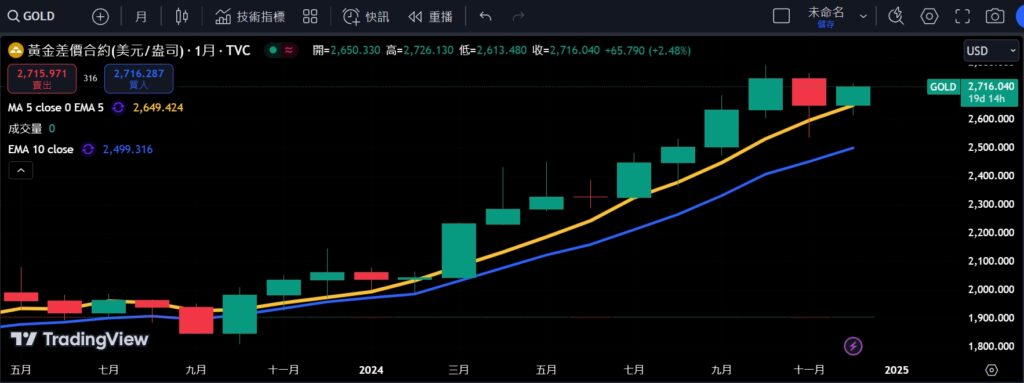

May 2024: A Milestone at $2,435 Per Ounce

May 2024 marked a historic milestone for gold prices, as they soared to $2,435 per ounce. This new record reflected a confluence of economic and geopolitical events that reinforced gold’s status as a safe-haven asset.

A pivotal factor was the growing speculation that the U.S. Federal Reserve might pivot toward cutting interest rates later in the year. As inflationary pressures persisted despite previous rate hikes, markets began to anticipate a shift in monetary policy, weakening the U.S. dollar and boosting gold’s appeal.

Geopolitical tensions also remained elevated. Ongoing instability in Eastern Europe, coupled with new conflicts in the Middle East, further destabilized global markets. Investors, concerned about potential supply chain disruptions and energy price spikes, turned to gold as a reliable store of value.

Adding to this momentum, central banks in Asia and the Middle East ramped up their gold purchases, aiming to diversify reserves amidst global economic uncertainties. Meanwhile, the gold supply remained constrained due to challenges in mining operations, contributing to tighter market conditions.

By May’s end, gold’s rally had solidified its position as one of the top-performing assets of 2024, signaling the market’s enduring confidence in the metal as both a hedge and an investment opportunity.

October 2024: A Historic High of $2,787 Per Ounce

October 2024 marked a watershed moment for the gold market, as prices skyrocketed to an all-time high of $2,787 per ounce. This remarkable surge was the culmination of a year marked by persistent economic uncertainty, geopolitical volatility, and shifting central bank policies.

A critical driver of this peak was escalating tensions in East Asia, where rising disputes over territorial claims triggered fears of broader regional conflict. Coupled with ongoing instability in Eastern Europe and the Middle East, these developments created a climate of heightened risk aversion, fueling global demand for gold.

Economic factors also played a pivotal role. In the U.S., uncertainty surrounding Federal Reserve policies intensified, with mixed signals about future interest rate cuts amid slowing economic growth. Inflation remained stubbornly above targets, eroding confidence in traditional assets and reinforcing gold’s safe-haven status.

Moreover, central banks worldwide continued to stockpile gold, with record-breaking purchases reported by countries in Asia, the Middle East, and Latin America. These actions, motivated by a desire to reduce reliance on the U.S. dollar, further tightened gold supplies and supported higher prices.

Retail and institutional investors joined the rally, seeking protection against currency volatility and potential financial market disruptions. As demand surged and supply constraints persisted, October’s peak underscored gold’s enduring value in an uncertain world.

This historic milestone cemented gold’s position as one of the most sought-after assets of 2024 and raised expectations for further gains in the years to come.