Gold’s Second Peak, culminating in the 2011 surge to $1,900 per ounce, was the result of a series of pivotal events that began in the early 2000s. This period laid the groundwork for one of the most significant bull markets in gold’s history, driven by a complex interplay of economic, geopolitical, and market forces. From the aftermath of the dot-com bubble burst and the economic ramifications of the September 11 attacks to the introduction of the euro and the Iraq War, each event contributed to the growing appeal of gold as a safe-haven asset. By examining these early years, we can understand how rising oil prices, inflation concerns, and global uncertainties fueled a sustained increase in gold prices, setting the stage for the historic peak that would follow.

2000-2001: “Dot-Com Bubble Burst and Recession: Setting the Stage for Gold’s Rise”

The late 1990s saw a dramatic rise in the stock prices of technology companies, fueled by speculation and the rapid growth of internet-based businesses. This period, known as the dot-com bubble, saw the NASDAQ Composite Index surge by approximately 400% between 1995 and 2000. However, by March 2000, the bubble began to burst as it became evident that many of these companies had overvalued stocks and unsustainable business models. The NASDAQ index plummeted, losing almost 80% of its value by October 2002. This crash led to significant financial losses and a loss of investor confidence in the stock market, driving many to seek safer investments like gold.

Recession and Economic Uncertainty (2001): Following the burst of the dot-com bubble, the U.S. economy entered a recession in early 2001. The downturn was marked by declining consumer confidence, reduced corporate spending, and rising unemployment rates. The Federal Reserve responded by cutting interest rates multiple times to stimulate economic activity, but the lingering effects of the recession created a climate of economic uncertainty. During periods of economic instability, investors often turn to gold as a safe-haven asset to protect their wealth from market volatility and currency devaluation.

September 11 Attacks (2001): The terrorist attacks on September 11, 2001, further exacerbated economic fears and geopolitical tensions. The immediate aftermath saw a dramatic drop in stock markets worldwide, with the Dow Jones Industrial Average experiencing its largest one-day point loss up to that time. The attacks led to increased government spending on security and defense, further straining the economy. The uncertainty and fear triggered by these events pushed more investors towards gold, seeking a stable and secure investment.

2002: “Introduction of the Euro: Shifting Global Economic Dynamics”

On January 1, 2002, the euro was introduced as the official currency for 12 of the 15 member states of the European Union (EU). This marked the final stage of the Economic and Monetary Union (EMU) process, with euro banknotes and coins entering into circulation. The transition from national currencies to the euro aimed to facilitate easier trade and economic stability within the eurozone.

Economic Impact: The introduction of the euro created one of the largest economic zones in the world, making it easier for member countries to trade with each other and reducing currency exchange risks. This significant shift in the global economic landscape had profound effects on international trade and finance. The euro quickly became the second most traded currency in the world after the US dollar, reinforcing its importance in global markets.

Investor Response: The euro’s introduction brought both opportunities and uncertainties. On one hand, the creation of a unified currency zone was expected to promote economic stability and growth within the eurozone. On the other hand, investors were cautious about potential risks associated with the new currency, such as the differing economic conditions and fiscal policies of member countries. This uncertainty contributed to a mixed reaction in financial markets.

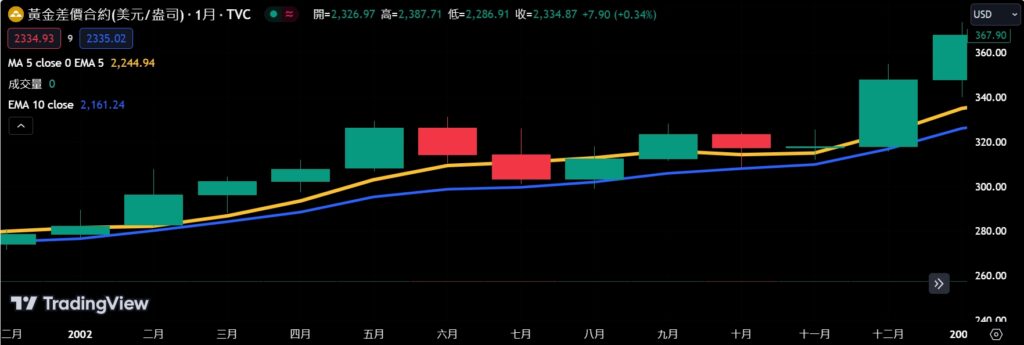

Gold as a Hedge: As with any major economic shift, the introduction of the euro led to increased demand for gold as a hedge against currency volatility. Investors sought to protect their portfolios from potential risks associated with the euro’s adoption. In 2002, gold prices began to rise steadily, reflecting the heightened demand for the metal as a safe-haven asset. By the end of 2002, gold had climbed to approximately $342 per ounce, up from around $279 per ounce at the start of the year.

Economic Policies and Market Reaction: The European Central Bank (ECB) played a crucial role in managing the euro’s introduction, implementing monetary policies aimed at maintaining price stability and fostering economic growth. The ECB’s actions, along with fiscal policies of individual member states, influenced investor confidence in the euro. During this period, the global market was closely monitoring the performance of the euro and its impact on international trade and investment.

Global Trade Dynamics: The euro’s introduction also affected global trade dynamics. As the euro gained acceptance, it began to challenge the dominance of the US dollar in international trade and finance. Countries and businesses started diversifying their currency reserves and transactions, considering the euro as an alternative to the dollar. This shift had implications for global economic policies and strategies, further underscoring the role of gold as a universal store of value amidst changing economic conditions.

2003: “Iraq War: Heightened Uncertainty and its Impact on Gold Prices”

In the early 2000s, the geopolitical landscape was marked by significant tensions and uncertainties, particularly related to the Middle East. Following the September 11 attacks in 2001, the United States intensified its focus on combating terrorism and addressing perceived threats. One of the primary targets was Iraq, led by Saddam Hussein, whom the U.S. government accused of possessing weapons of mass destruction (WMDs) and having ties to terrorist groups.

Prelude to War: In late 2002 and early 2003, diplomatic efforts and inspections by the United Nations aimed at disarming Iraq and verifying the absence of WMDs intensified. However, these efforts failed to produce conclusive results, and the U.S., along with the United Kingdom and other allies, pushed for military intervention. The prospect of war created significant uncertainty in global markets, including commodities like gold.

Start of the Iraq War (March 2003): On March 20, 2003, the United States, supported by a coalition of allies, launched a military invasion of Iraq. The operation, dubbed “Operation Iraqi Freedom,” aimed to overthrow Saddam Hussein’s regime and eliminate the threat of WMDs. The onset of the war led to immediate reactions in global financial markets. The uncertainty surrounding the conflict, including its potential duration and impact on global oil supplies, drove investors to seek safer assets.

Gold Prices Surge:

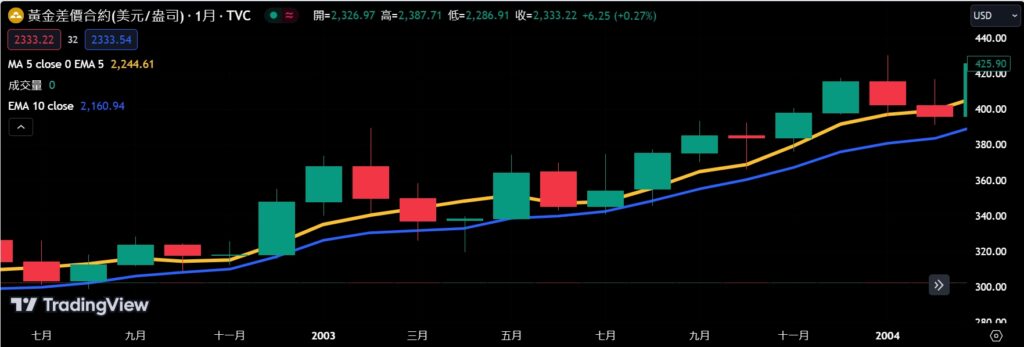

January 2003:

- Starting Price: Around $342 per ounce

- Events: The build-up to the Iraq War intensified with the U.S. and its allies making a final push for military action. The uncertainty surrounding the potential conflict increased demand for gold.

- Price Movement: Gold prices began to rise steadily, reflecting investor concerns about the impending war.

February 2003:

- Price Range: $350 – $370 per ounce

- Events: Diplomatic efforts continued, but the likelihood of war appeared imminent. The market reacted to various statements from U.S. officials and movements of military forces towards the Middle East.

- Price Movement: Gold prices saw further increases as the geopolitical tensions heightened.

March 2003:

- Price Peak: Around $389 per ounce in early March

- Events: On March 20, 2003, the U.S.-led coalition launched Operation Iraqi Freedom, marking the beginning of the Iraq War.

- Price Movement: Gold prices spiked in the days leading up to the invasion, peaking around $389 per ounce. Following the start of the war, there was some stabilization as initial uncertainties were resolved.

April 2003:

- Price Range: $325 – $350 per ounce

- Events: The initial phase of the Iraq War proceeded quickly with the fall of Baghdad in early April. Market uncertainties began to ease slightly as the conflict appeared to be progressing favorably for the coalition.

- Price Movement: Gold prices experienced some volatility but generally remained elevated compared to the pre-war period.

May – June 2003:

- Price Range: $340 – $360 per ounce

- Events: The focus shifted to the post-war reconstruction and the challenges of stabilizing Iraq. Concerns about the broader implications for the Middle East persisted.

- Price Movement: Gold prices remained relatively stable, with minor fluctuations as investors continued to monitor the situation.

July – August 2003:

- Price Range: $350 – $370 per ounce

- Events: Continued reports of insurgency and instability in Iraq kept geopolitical risks high. Additionally, global economic conditions were mixed, contributing to sustained demand for gold.

- Price Movement: Gold prices saw a gradual upward trend during the summer months.

September – October 2003:

- Price Range: $360 – $380 per ounce

- Events: Uncertainties about the global economic recovery and ongoing geopolitical tensions, including those related to Iraq and other parts of the Middle East, supported gold prices.

- Price Movement: Prices continued to climb, reflecting the persistent demand for safe-haven assets.

November – December 2003:

- Price Peak: Around $416 per ounce by the end of the year

- Events: As the year drew to a close, gold prices were buoyed by a combination of factors, including concerns over the U.S. dollar’s weakness, ongoing geopolitical risks, and inflationary pressures.

- Price Movement: Gold reached its highest point of the year in December, closing around $416 per ounce

2004-2005: “Rising Oil Prices and Inflation Concerns: Early Indicators of a Gold Bull Market”

The years 2004 and 2005 were critical in the build-up to the gold bull market that would culminate in the 2011 peak. During this period, rising oil prices and growing concerns about inflation played significant roles in driving gold prices higher. These factors, along with geopolitical uncertainties and economic policies, contributed to the increased attractiveness of gold as a safe-haven asset.

Rising Oil Prices:

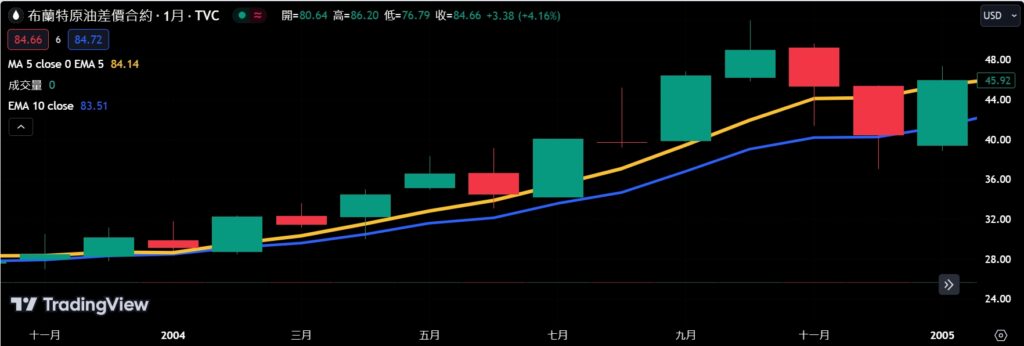

2004:

- Events: Oil prices began to climb significantly due to several factors, including increased global demand, particularly from rapidly growing economies like China and India, and geopolitical tensions in key oil-producing regions.

- Price Movement: In 2004, crude oil prices surged, reaching over $50 per barrel by October, up from around $30 per barrel at the beginning of the year.

- Impact on Gold: The rise in oil prices contributed to fears of inflation, as higher energy costs tend to increase the overall cost of goods and services. Investors, anticipating inflationary pressures, turned to gold as a hedge, driving its price from around $415 per ounce in January 2004 to approximately $435 per ounce by December 2004.

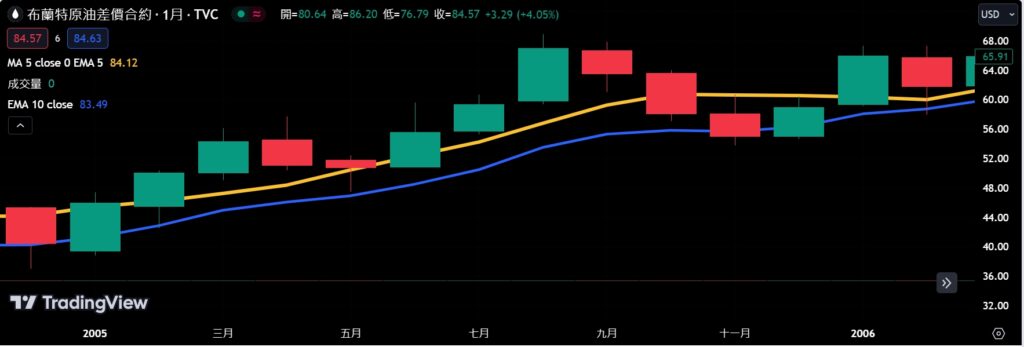

2005:

- Events: Oil prices continued their upward trajectory, influenced by ongoing geopolitical issues, including instability in the Middle East and production disruptions caused by natural disasters like Hurricane Katrina, which struck the Gulf Coast of the United States in August 2005.

- Price Movement: Crude oil prices peaked at around $70 per barrel in August 2005. The sustained high oil prices maintained inflation concerns among investors.

- Impact on Gold: As a result, gold prices continued to rise, climbing from about $435 per ounce at the start of 2005 to around $515 per ounce by the end of the year. This increase reflected the heightened demand for gold as a protective measure against the anticipated rise in inflation.

Inflation Concerns:

Economic Context:

- 2004-2005: The global economy was experiencing robust growth, but this was accompanied by rising inflationary pressures. Central banks, particularly the Federal Reserve in the United States, began to signal concerns about inflation and the need for potential interest rate hikes.

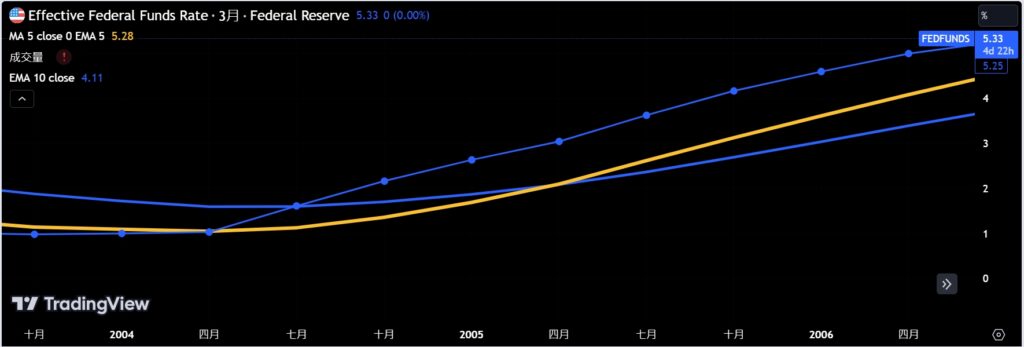

- Monetary Policy: The Federal Reserve, under Chairman Alan Greenspan, started to increase the federal funds rate in a series of steps, raising it from 1% in mid-2004 to 4.25% by the end of 2005. These rate hikes were aimed at curbing inflation but also signaled to investors the seriousness of the inflation threat.

Geopolitical Tensions:

- Middle East Instability: Geopolitical tensions in the Middle East, particularly related to Iraq and Iran, continued to contribute to uncertainties in the global oil supply, further fueling inflation fears.

- Global Trade Dynamics: Rising commodity prices, including metals and agricultural products, also contributed to the broader inflationary environment. This global trend underscored the interconnected nature of energy prices, inflation, and the demand for safe-haven assets like gold.

Market Sentiment:

- Safe-Haven Demand: Investors increasingly sought gold as a store of value amid the backdrop of rising oil prices and inflation concerns. The perception of gold as a hedge against economic instability and currency devaluation bolstered its attractiveness.

- Investment Trends: There was a notable increase in investment in gold-related financial products, including gold exchange-traded funds (ETFs), which made it easier for a broader range of investors to gain exposure to gold. This shift in investment behavior further supported the upward trend in gold prices.

You want to know more about gold…

- Catalyzing the 1980 Gold Price Explosion (the First Peak): From 1971 The Bretton Woods Fallout

- Russia’s Gold Reserves Since 2009 Surge by 360% : Inside the Central Bank’s Strategic Move

- China Buys Over 1,200 Tons of Gold Since 2009: A Decade-Long Strategic Rush

- India’s Golden Surge: RBI Increases Gold Reserves by almost 500 Tonnes Since 2009 Amid Global Economic Shifts

- Central Bank of Turkey Increased Gold Reserves by Over 100% from 2017 to 2024